Don’t Fall Into Debt: Easy Ways To Avoid It

When you have a family, it’s so easy to end up falling into debt. After all, there are so many bills you have to pay out for every month. And then you have to buy clothes for your family. And that’s before other things like holidays and birthdays. But while a lot of families fall victim to debt, it’s not always a guarantee. In fact, here are some easy ways you can avoid falling into severe debt.

Keep on Top of Your Bank Accounts

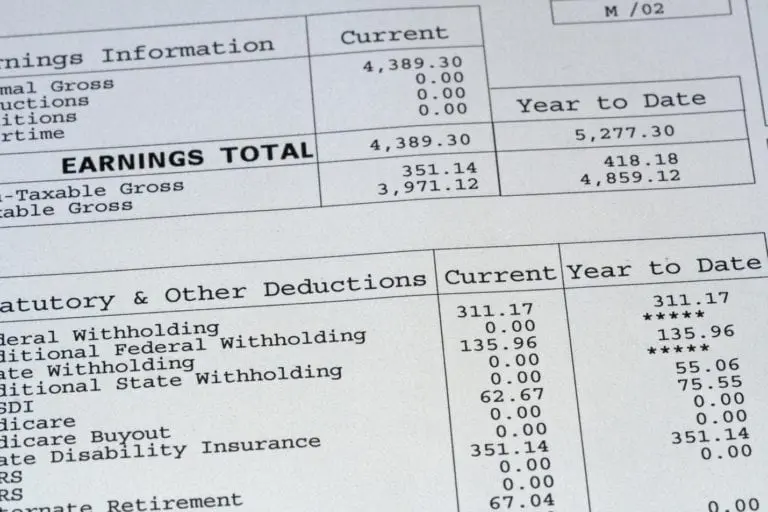

The first thing you need to do if you want to avoid debt in your life is to make sure you are keeping on top of your bank accounts. After all, a lot of us are guilty of spending money without checking what’s in our account. It’s so easy to just pass over our card, and the transaction is done. But if you don’t know exactly what you spent, you are soon going to run into trouble. Therefore, it’s so important to make sure you check your account at least once a week. You can then check what payments have gone out. Doing this can also alter your spending. After all, if you see you are constantly spending too much on your kid’s clothes, you can then make cutbacks. Therefore, keep an eye on your bank accounts to avoid money woe!

Go for Legitimate Loans rather than Payday Scams

You might need to take out a loan when it comes to your family’s life. After all, we often don’t have the funds to pay out fully for a new family car or a holiday. But when you start getting loans, it can lead you to trouble. Therefore, before you get any loan from a company, you need to make sure you do your research. After all, you don’t want to end up getting a loan from a payday scam which sends you spiraling into debt. The interest can be huge on these kinds of loans. You can read more about certain loans online on sites like http://debtsolutionsreviewed.com/onemain-financial-review. After all, you can then know whether the company is legitimate to borrow from and it will stop you making a terrible error. After all, you want something you can easily afford to pay back monthly. And remember even if you have bad credit, some places can still give you a loan. You can read more about this on my previous blog.

Be Wise With Your Spending

A lot of people get into debt as they don’t think twice about spending money. They might buy things for their kids or for the family home without a second’s thought. But if you don’t think realistically about whether you can afford it, your family could soon be spiraling into debt. Therefore, always decide how ‘essential’ the item is to your family. If it’s something you are just buying for the point of it, it’s time to put it back on the shelf. And as it says on http://money.allwomenstalk.com/top-ways-to-avoid-getting-into-debt/5, always check if there are any deals or coupons online before buying an item. After all, it could save you a ton of money!

And if you do feel like your family is heading towards debt, it would be best to make some changes now. For example, cutting down your heating use or making some cuts at the grocery store could make all the difference.

Similar Posts:

- How to Get a Loan: A Brief Guide to Taking out a Loan

- Deep Clean Your Finances With These Tips!

- What Parents Should Know About Finances

- Follow These Personal Loan Application Tips if You Have Bad Credit

- The Type of Loans That are the Fastest