The Money-Management Mistakes You Can’t Afford To Make

Every single homeowner knows just how important it is to keep tight control of their household finances. By correctly managing them, they will be able to afford their monthly bills and other living expenses, while still having some cash left over at the end of the month to squirrel away into savings. However, this can be a lot easier said than done.

There are quite a few common mistakes that are ever so easy to make when it comes to managing the household finances. Unfortunately, it can be easy for even the most financially savvy individual to end up falling into these pitfalls every so often. Don’t want this to happen to you? Here are the big errors that you need to watch out for.

Switch When Necessary

Did you know that you might save a lot of money by switching your utility suppliers? This includes things such as electricity, your internet plan, and gas. Lots of homeowners believe that switching to a new supplier can be very complicated and time-consuming, but this isn’t really the case. In fact, if you regularly switch your plans, such as every couple of years, you could benefit from a lot of discounts that major utility suppliers offer new customers.

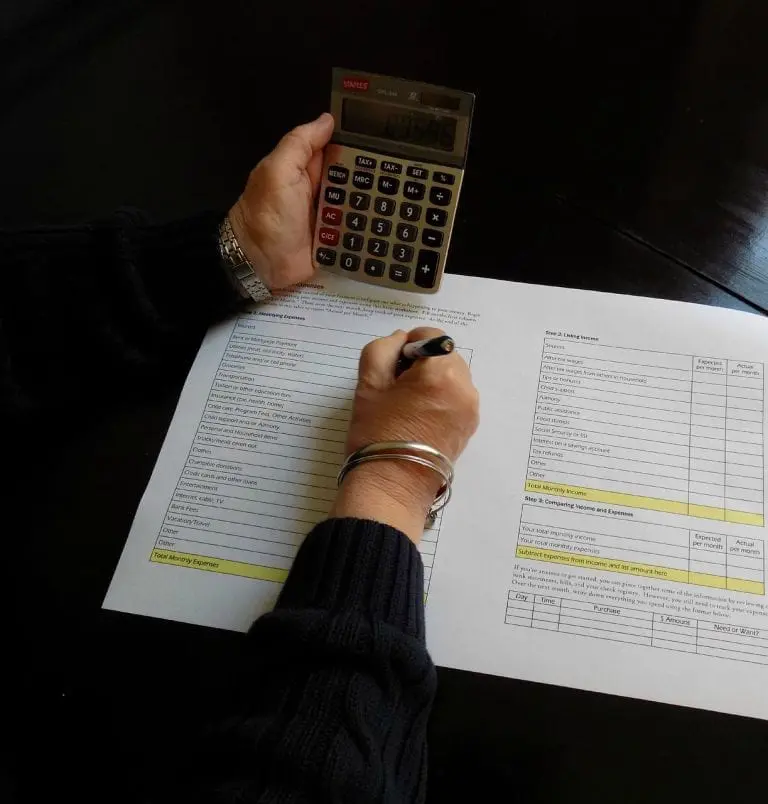

Not Having A Good Overview Of Where Your Money Goes

Even though most of us will have a budget for all household expenditures, some of us don’t check it all that often. Because of this, it can be all too easy to have a poor overview of where all your money is going. It’s really important that you are on top of your finances at all times so that there is no risk of you ever overspending. Once you’ve got a handle on your outgoings it can become easier to write up your expenses and incomes to figure out what money you’ve got left each month for everything else. It’s at this point you should consider long term saving rather than spending any excess you have. Consider learning how to invest and practice using a funded futures trading account to get familiar, after which you can start putting your leftover money to work for better long term financial security.

Forgetting About Non-Regular Expenses

Even though it can be easy to keep track of regular monthly expenses, such as grocery shopping and utility bills, some people forget to track their non-regular outgoings. However, you really need to add these into your budget so that you can see how they affect your overall spending and finances. If you don’t, you might slip into debt without realizing it.

Living From One Paycheck To The Next

Even though wages are quite low at the minute and don’t show any signs off possibly rising, it is still essential to try to save at the end of each month, no matter how little that may be. If you are living from paycheck to paycheck, there are ways to change it. For instance, you might want to take out your savings at the beginning of the month so that there is no risk of you spending them.

Being Frugal With Retirement Savings

Hopefully, you are already saving for retirement. Try not to be too frugal with these savings, as the more you put away means the more comfortable you will be able to live once you have stopped working. Being frugal with your retirement savings will only make things harder in the long run.

Use the tips above to transform your finances for the better!