5 Tips To Set Up A Family Budget and Pay Down Debts

One of the hardest parts of life is managing the family finances. About 87% of American families go to bed at night with the burden of debt on them. Some people intentionally and knowingly take on the debt while many become buried due to a lack of understanding. Financial literacy and a family budget can help offer salvation. The beginning path to financial freedom begins with these five tips that will help build your foundation. Keep reading to find out ways to set up a family budget.

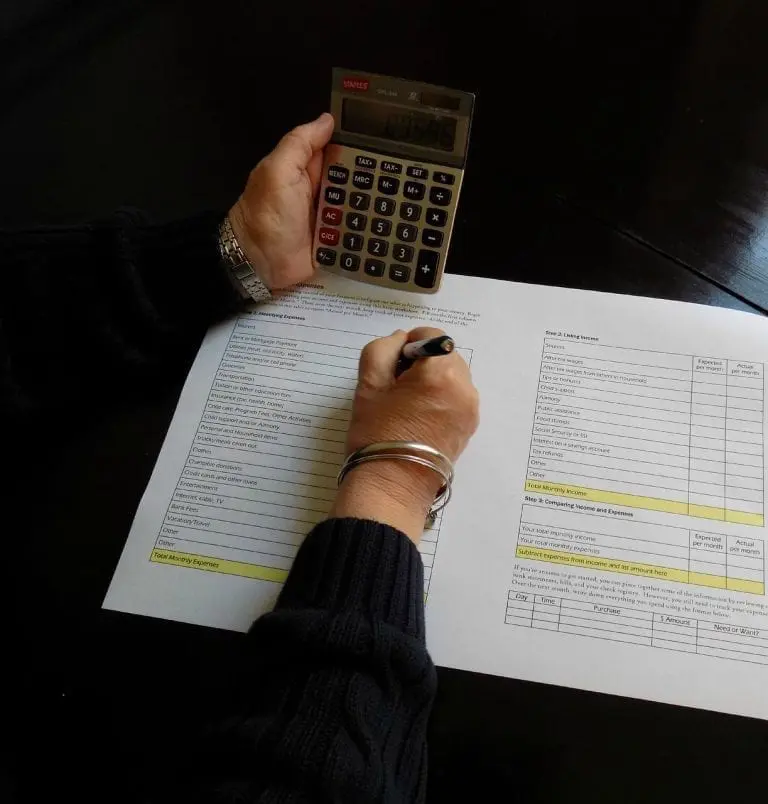

Create a Budget

What is a “budget”? A budget is an estimated figure of how much money will be earned and spent in a given time.

The first thing you should do is track all revenue streams and expenditures for the previous month. Look at the expenses and decide what is necessary and what is extra.

Necessary costs include:

- Mortgage or rent payments

- Utilities

- Transportation

- Groceries

- Medicine

Extra unnecessary costs include:

- Restaurants

- Movies

- Lottery tickets

- Extravagant clothes/toys/jewelry

There are plenty of other examples for each category but these tend to be the most prevalent.

If you fail to create a budget, then you may forget to slash extra spending and start using more money than you earn. This will only contribute to your debt.

Goals for Family Finances

Just like anything else in life, setting goals helps push and inspire people to improve their current status. Saving money to climb out of debt is the ultimate goal.

By knowing where and how much money will be available after expenses are paid, you can establish the amount of money to be used to pay off your debt.

The amount of money you have available may change monthly, but there should always be some going towards your savings account regardless of the amount going towards debt. Keep some money stashed away for emergencies and continually add to that pile.

Budget for Emergencies

In your budget, assume you will have to contribute some money to unforeseen emergencies. If you navigate the month without any emergencies, you will have that money available to you for saving or other expenses.

It is wise to let an emergency fund grow when you need it. With the curveballs, life throws, there may be an expensive procedure, car fix, or purchase in your future.

Control Your Travel

Should you cut out vacation this year? It might be something you need to do. But hopefully, you still enjoy some time off.

Instead of taking that luxurious trip down to the Caribbean, do a “staycation” where you take time off but don’t go anywhere. This will give you time to finish that long list of chores or catch up on your favorite TV show.

Side Job/Hustle

Look around your house or apartment. There may be enough treasures in your home that you can have a garage sale or a robust online store. Do you have a talent or skill that can be used to make a few extra dollars?

Walking dogs, cleaning apartments, or freelance writing are all good options for people who need an extra revenue stream on the budget sheet.

What’s Next?

You have debt to your name, but you don’t have to stay there. If your situation is becoming overwhelming and are in need of debt consolidation, some organizations will provide a bad credit loan quick.

Use these tips for your family finances and set up a family budget that will get you out of debt.